We often come across terms like stocks, bonds, and mutual funds, but they can seem a bit overwhelming, don’t they? The goal of quality financial writing is to break them down into simpler, more understandable concepts. It aligns with industry standards, taking those tricky concepts and turning them into simple, actionable advice that ensures effective communication and helps readers feel more confident.

Let’s check out some examples of financial writing that really works, supported by real-world applications, to improve your content strategy.

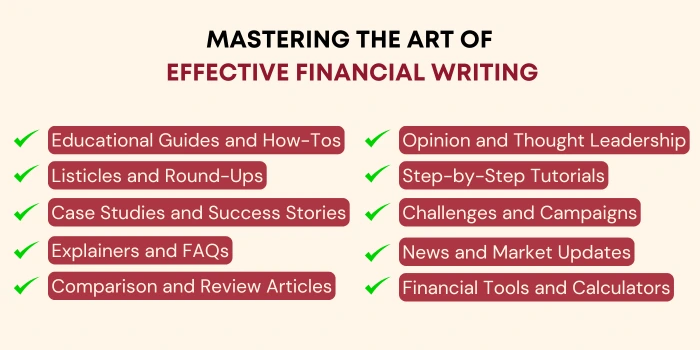

Let’s discuss practical strategies and formats that make financial topics more fun to read and deliver real value.

Educational guides transform complex financial topics into easy-to-understand steps, adhering to industry standards while building effective communication.

We often turn to search engines with phrases starting with “How to,” like “How to Save for Retirement in Your 30s” or “How to Build a Monthly Budget.” These types of guides are incredibly effective because they align with what people are already searching for.

Focusing on what your audience is searching for helps you provide straightforward, practical advice that can be applied immediately.

Listicles are an effective financial writing format because they are quick, scannable, and packed with value.

Articles like “10 Simple Ways to Save Money Every Day” or “Top Investment Apps You Need in 2024” deliver digestible tips that align with industry standards while promoting effective communication through a clear and organized structure.

Real-life stories of financial triumphs, like "How I Paid Off $50,000 in Debt in Two Years," show that big financial goals are achievable for anyone willing to work hard. These stories inspire readers to take control of their finances and believe that success is within reach, not just a distant dream.

Similarly, case studies provide real examples of how strategies work in action, offering readers actionable insights they can apply to their own financial situations.

Financial writing becomes more impactful when it combines success stories to show the "what" with case studies that break down the "how."

Explainers and FAQs are your best friends when it comes to making finance easier to understand. Explainers take those tricky financial terms and break them down in a way that clicks, so readers feel more confident about the topic. When done right, they follow industry standards and communicate the facts clearly, without confusing anyone.

FAQs step in to answer those “What about this?” questions readers might have, clearing up any confusion and giving extra value. Including FAQs also helps with SEO, since search engines love content that answers the questions people are actually searching for. So, by adding both, you’re making your financial writing more helpful and easier to find.

People are always looking for the latest updates in the financial world. Articles like "What the Latest Fed Decision Means for Your Wallet" help break down complicated market moves into something we can all understand. Instead of just throwing out numbers and jargon, good financial writing explains what’s really going on and how it affects the everyday person.

When you highlight trending topics and provide simple, clear takeaways, you're making it easier for your readers to stay informed and take action. It’s about turning the news into something useful, not just throwing out facts. By breaking down complex updates in a relatable way, readers will know how to respond to what’s happening in the financial world.

Comparison and review articles in finance help readers make better decisions by explaining different financial products clearly. These articles compare options based on things like interest rates, fees, and features, making it easier for readers to see which option is best for them. A good article will break down the details of each option, compare it to others, and give an honest recommendation.

The key is to keep financial writing simple, straightforward, and easy to understand, so readers can quickly grasp the information and make informed choices. Also, a simple side-by-side comparison makes tough decisions easier and more reliable.

Adding tools and calculators to your articles can really make a difference. For example, if you’re talking about recurring deposits (RD), you could include a calculator where readers can easily figure out their RD returns based on their own numbers.

When people can do the calculations themselves, they’re more likely to come back to your article whenever they need help with something similar. It’s a great way to turn general advice into something practical and immediately useful. Financial writing is all about making the info practical and easy to use!

Sometimes, a strong opinion is exactly what readers are looking for. Articles that dive into big financial topics, like the future of cryptocurrency or changes in tax laws, give readers something to think about.

When you back up your opinion with data and expert knowledge, you show readers you’re a trusted voice they can rely on.

When it comes to financial tasks, a little guidance can go a long way. Whether it’s filling out your tax forms or setting up a budget, a step-by-step tutorial makes the whole process a lot less intimidating.

Breaking down complicated steps into easy-to-follow instructions makes everything feel more manageable and ensures readers feel supported.

Getting people involved in a challenge or campaign is a fun way to help them stay on track with their goals. Campaigns like “Save $1,000 in 30 Days” or “Debt-Free in a Year Challenge” make financial progress feel like a team effort.

When readers are part of a community working toward similar goals, they’re more likely to stick with it. Plus, it’s a great way to keep things exciting and interactive.

How do these top financial platforms keep their readers engaged? They do it with practical advice, relatable stories, and easy-to-follow resources.

Let’s explore some of these top financial writing websites.

Focus: Simplified personal finance and credit advice.

Focus: Relatable money-saving advice with a personal touch.

Focus: Educational content on investing, finance, and economics.

Focus: Budgeting, financial management, and goal-setting tools.

Focus: Digestible daily updates on finance, business, and tech news.

Financial writing that connects requires a balance of clarity, trust, and practicality to truly connect with your audience.

These top examples show that with the right strategy, even the most complex financial concepts can be turned into engaging, easy-to-digest content. Want to craft content that resonates with your audience? Get in touch with Lexiconn! We specialize in creating financial content that’s both informative and reader-friendly. With experience working with leading financial companies, we offer a free pilot and a 30-minute consultation to help you get started.

Check out our case study to see how LexiConn helped Nuvama Wealth build thought leadership and drive impactful results! Let’s work together to bring your financial content to life and engage your audience like never before!

I have read and accept the Privacy Policy

Read More